Low Payouts on Hurricane Damage Claims: A Guide for Florida Homeowners

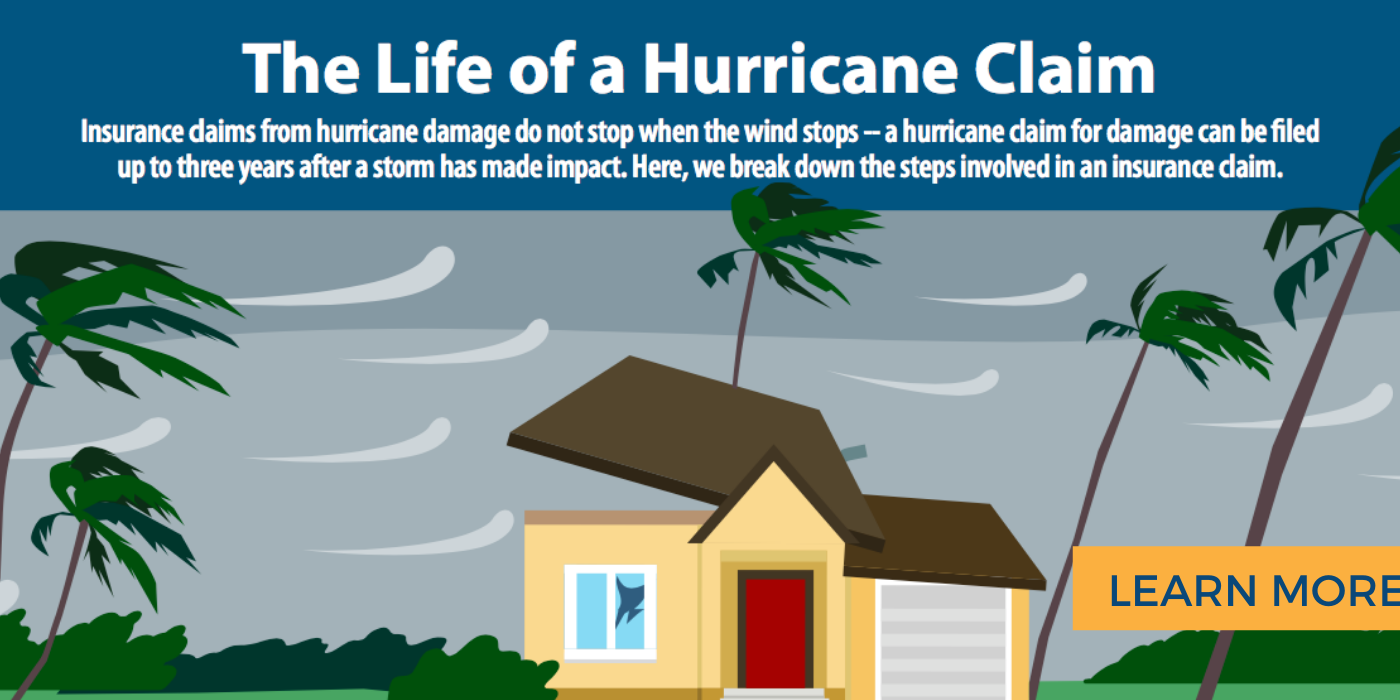

Florida, renowned for its stunning beaches and balmy weather, is also a state susceptible to the wrath of hurricanes. For homeowners, ensuring adequate insurance coverage is paramount. However, when faced with a low payout on hurricane damage claims, it can be a frustrating and disheartening experience. This article aims to shed light on common reasons for low payouts, steps to take if you find yourself in this situation, and proactive measures to secure fair compensation.

Hurricane Ian Insurance Payout Dispute

Common Reasons for Low Payouts

Policy Coverage Gaps: Homeowners may face low payouts if their insurance policy doesn’t adequately cover specific types of hurricane-related damages. For instance, flood damage is often excluded from standard homeowner’s insurance policies and requires a separate flood insurance policy.

High Deductibles: Some policies have high deductibles for hurricane-related claims. This means that homeowners must pay a significant amount out-of-pocket before their insurance coverage kicks in. High deductibles can result in lower payouts.

Depreciation and Actual Cash Value: Some policies pay out based on the actual cash value of damaged items rather than the cost to replace them with new ones. This takes into account depreciation, which can significantly reduce the payout amount.

Law Firm to dispute low hurricane Ian payout

Inadequate Documentation: Insufficient or poorly documented evidence of damages can lead to low payouts. It’s crucial to thoroughly document all damage, including photographs, videos, and detailed descriptions.

Dispute over Repairs and Replacement Costs: Insurance companies may undervalue repairs or replacements, leading to lower payouts. It’s important to get multiple estimates from reputable contractors to establish the true cost.

Steps to Take If You Receive a Low Payout

Review Your Policy: Thoroughly review your insurance policy to understand the terms, coverage limits, and any exclusions that may be affecting your payout.

Seek an Explanation: Contact your insurance company to request a detailed explanation for the low payout. Understand the specific factors that contributed to the valuation.

Obtain Multiple Estimates: If you believe the estimates provided by your insurance company are too low, seek multiple estimates from reputable contractors. This can help establish a fair market value for repairs and replacements.

Dispute claim payout hurricane Ian

Consider Hiring a Public Adjuster: A public adjuster works on behalf of the policyholder and can help negotiate with the insurance company to secure a fair settlement. They have expertise in assessing damages and understanding insurance policies.

File an Appeal: Many insurance companies have an appeals process in place. If you believe your claim has been undervalued, go through the appeals process as outlined in your policy.

Proactive Measures to Secure Fair Compensation

Review and Update Your Policy Regularly: Periodically review your insurance policy to ensure it adequately covers your home and possessions. Consider making adjustments based on changes in property value, renovations, or additions.

Consider Additional Coverage Options: Depending on your location, it may be beneficial to explore additional coverage options such as flood insurance, windstorm insurance, or other endorsements that can provide added protection in the event of a hurricane.

Hurricane Ian Insurance Claim Law Firm

Document Pre-Existing Damage: Before a hurricane strikes, document the condition of your property and possessions. This can help establish the baseline for any future claims.

Dealing with a low payout on hurricane damage claims can be a challenging experience. However, with careful documentation, proactive measures, and a clear understanding of your policy, you can increase your chances of securing fair compensation. Remember to consult professionals, such as public adjusters or legal experts, if you encounter difficulties in the claims process. By being informed and persistent, you can better protect your home and assets in the aftermath of a hurricane.

Keep Detailed Records: Maintain a comprehensive record of all communication with your insurance company. This includes emails, letters, phone calls, and in-person meetings. These records can serve as evidence of your efforts to seek fair compensation.

Engage an Independent Appraiser: If you’re dissatisfied with the insurance company’s assessment of damages, consider hiring an independent appraiser. They can provide an unbiased evaluation of the extent of the damage and the cost of repairs.

Document All Expenses: Keep records of any expenses related to temporary accommodations, meals, and other costs incurred due to the damage. These may be reimbursable under your policy and can help you recoup some of your losses.

Be Mindful of Deadlines: Insurance policies often have strict deadlines for filing claims and appeals. Make sure to adhere to these timelines to ensure your claim remains valid.

Consider a Mediation or Arbitration Process: Some policies include provisions for mediation or arbitration in case of disputes. These processes involve a neutral third party who can help facilitate negotiations and reach a resolution.

Seek Legal Advice: If you’ve exhausted all avenues and still feel that you’re not receiving a fair payout, consult with an attorney who specializes in insurance law. They can provide legal guidance and may be able to represent your interests.

Explore Consumer Advocacy Groups: In Florida, there are advocacy organizations that can provide support and resources for homeowners facing difficulties with insurance claims. These groups may be able to offer guidance or connect you with professionals who can assist.

Stay Informed About Policy Changes: Keep abreast of any changes or updates to your insurance policy. Understanding the terms and conditions can help you navigate the claims process more effectively.

Consider the Option to Cancel and Seek a New Policy: While this may not be the first choice for every homeowner, if you consistently face low payouts or unsatisfactory service from your current insurer, it might be worth exploring other insurance providers.

Dispute low home insurance claim payout

Maintain Open Communication: Continuously communicate with your insurance company and any professionals you’ve engaged, such as public adjusters or attorneys. Clear and open communication can help ensure everyone is aligned in pursuing a fair resolution.

Remember, it’s essential to be persistent, patient, and thorough when dealing with low payouts on hurricane damage claims. Each situation is unique, and seeking professional advice when needed can significantly impact the outcome. By taking proactive steps and advocating for your rights, you increase the likelihood of receiving fair compensation for the damages incurred.