Performance Bonds and Contract Bonds: Comprehensive Protection for Construction Success

Construction projects involve complex relationships among owners, contractors, subcontractors, suppliers, lenders, and other stakeholders, each with significant financial interests at risk. When projects stretch over months or years with contract values reaching into millions of dollars, protecting these investments becomes paramount. Performance bonds and contract bonds provide the essential security mechanisms that enable construction projects to proceed with confidence, knowing that contractual obligations are backed by financial guarantees. As a premier Tampa Bay FL performance bond provider with deep roots throughout the Southeast, Guignard Company has helped countless contractors secure the bonding coverage necessary to pursue and complete ambitious construction projects successfully.

Understanding Performance Bonds: The Foundation of Project Security

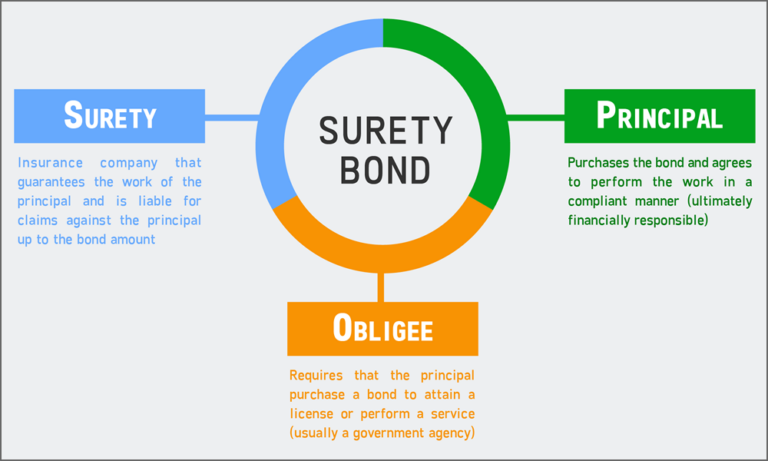

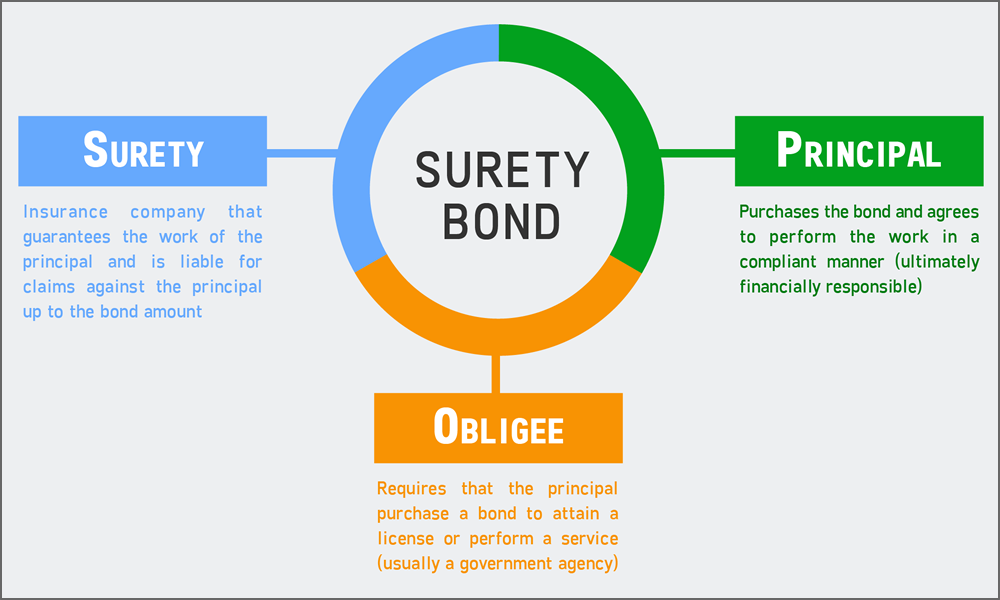

Performance bonds are surety instruments that guarantee contractors will complete their contracted work according to plans, specifications, schedules, and quality standards. Unlike insurance policies that protect policyholders from unforeseen risks, performance bonds protect project owners (obligees) by ensuring contractors (principals) fulfill all contractual obligations. The surety company acts as guarantor, providing financial backing and assuming responsibility if contractors fail to perform.

The fundamental mechanism is straightforward but powerful: if a contractor defaults on a bonded project—whether through abandonment, insolvency, failure to meet specifications, schedule delays, or other material breaches—the surety company steps in to remedy the situation. The surety has several options for addressing defaults including financing the original contractor to facilitate completion, hiring replacement contractors to finish remaining work, allowing owners to complete projects and reimbursing costs, or negotiating monetary settlements compensating owners for losses.

Performance bonds transfer substantial risk from project owners to surety companies. Without performance bonds, owners experiencing contractor defaults face potentially devastating consequences: incomplete projects representing sunk investments, expensive legal battles to recover losses, administrative burdens of finding and vetting replacement contractors, schedule delays affecting business operations or lease commitments, and potential exposure to claims from downstream parties like subcontractors. Performance bonds eliminate most of these concerns by guaranteeing project completion and providing financial resources to address contractor failures.

As one of the Top Central Florida surety bond providers, Guignard Company recognizes that performance bonds benefit multiple stakeholders beyond project owners. Lenders financing construction require performance bonds to protect their investments and ensure loan collateral reaches planned value. Tenants or buyers anticipating completed buildings need assurance of timely delivery. Subcontractors and suppliers working downstream from general contractors benefit from project stability that performance bonds provide. The entire construction ecosystem functions more smoothly when performance bonds back major projects.

Contract Bonds: The Comprehensive Framework

The term “contract bonds” serves as an umbrella encompassing all bonds related to construction contracts. While performance bonds form the centerpiece, comprehensive contract bonding typically includes multiple related bond types:

Bid Bonds: Guarantee that contractors who submit bids will enter into contracts at proposed prices if selected and will provide required performance and payment bonds. Bid bonds protect owners during the competitive procurement phase.

Performance Bonds: Guarantee work completion according to contract terms, plans, and specifications. These bonds protect owners throughout construction periods.

Payment Bonds: Guarantee that contractors will pay subcontractors, suppliers, and laborers who provide work and materials. Payment bonds protect downstream parties who lack direct contractual relationships with owners.

Maintenance/Warranty Bonds: Guarantee contractor obligations during post-completion warranty periods, ensuring repairs or corrections of defective work discovered after final acceptance.

Supply Bonds: Guarantee that material suppliers will deliver specified materials according to supply contracts—particularly relevant when materials represent substantial contract portions.

When project documents require “contract bonds,” they typically mean the combination of performance and payment bonds, though specific requirements should always be verified in contract terms. This comprehensive bonding framework reflects the construction industry’s recognition that multiple protection layers address various risks inherent in complex projects.

The Performance Bond Underwriting Process

Securing performance bonds requires contractors to undergo thorough evaluation by surety underwriters who assess qualifications through multiple dimensions:

Financial Strength Analysis: Surety underwriters conduct detailed financial examinations including balance sheet reviews assessing assets, liabilities, and equity; income statement analysis evaluating revenue, expenses, and profitability; cash flow statement scrutiny examining operational cash generation; working capital calculations determining available liquid resources; debt-to-equity ratio analysis assessing leverage; and financial trend identification spotting improvement or deterioration patterns.

Working capital—the difference between current assets and current liabilities—receives particular attention because it represents the financial cushion contractors can deploy when project challenges arise. Adequate working capital is essential for managing cash flow timing mismatches between project costs and payment receipts.

Experience and Capability Evaluation: Underwriters assess whether contractors have successfully completed projects similar to proposed bonded work in terms of project size and contract value, technical complexity and specialized systems, construction type and building methods, delivery approach (design-bid-build, design-build, CM-at-risk), and geographic region and market conditions.

A contractor with extensive experience building single-family homes would not automatically qualify for bonds on commercial high-rise construction without demonstrating relevant capability. Project resumes, owner references, and technical staff credentials support experience evaluation.

Capacity Assessment: Bonding capacity represents the maximum aggregate value of bonded work contractors can have in progress simultaneously. Sureties calculate capacity using working capital and net worth multiples, typically ranging from 10 to 20 times working capital depending on track records and financial strength.

For example, a contractor with $1.5 million in working capital might receive aggregate bonding capacity of $15 million to $22.5 million. Within that aggregate, single project limits might range from $3 million to $6 million depending on experience with various project sizes. As contractors successfully complete bonded work and strengthen financials, capacity grows to support larger individual projects and increased total backlog.

Character and Reputation Investigation: Beyond quantitative analysis, sureties investigate contractor character through industry reference checks, Better Business Bureau inquiries, litigation history searches, licensing board reviews, previous surety relationship examinations, and discussions with project owners, lenders, and subcontractors.

Contractors with histories of disputes, mechanics liens, payment complaints, or questionable business practices face heightened scrutiny or potential bond declinations. Clean records and positive reputations facilitate bonding approvals and better terms.

Project-Specific Risk Evaluation: In addition to general contractor qualifications, sureties assess individual project risks considering contract terms and risk allocation provisions, project owner financial stability and sophistication, project location, logistics, and site conditions, design completeness and specification clarity, construction schedule reasonableness, subcontractor prequalification and management approaches, and unusual technical requirements or innovative methods.

High-risk project characteristics may prompt additional underwriting requirements, capacity adjustments, or premium modifications reflecting increased exposure.

Performance Bond Premiums: Cost Factors and Calculations

Performance bond costs vary based on numerous factors but generally represent modest percentages of contract values for qualified contractors:

Premium Rate Variables: Base premium rates typically range from 0.5% to 3% of contract amounts. Key factors influencing rates include:

- Contractor Financial Profile: Stronger financials with substantial working capital, low debt ratios, consistent profitability, and clean audited statements command lower premiums. Weaker financial positions result in higher rates reflecting increased risk.

- Project Size and Complexity: Larger projects often benefit from volume discounts with declining rate structures. Straightforward projects receive better pricing than complex work involving specialized systems, innovative methods, or challenging logistics.

- Experience Depth: Proven track records with successful bonded project completions reduce premiums. Limited experience or first-time bonding situations carry higher costs.

- Contract Terms: Risk-shifting provisions like no-damage-for-delay clauses, restrictive change order procedures, aggressive payment terms, or unusual liability assumptions may increase premiums.

- Geographic Factors: Some regions or jurisdictions carry higher perceived risks due to economic conditions, regulatory environments, or historical claim patterns, potentially affecting rates.

Example Premium Calculations: Consider a $4 million commercial office building project. A contractor with excellent credentials might pay $30,000 in combined performance and payment bond premium (0.75% rate). A contractor with moderate qualifications might pay $80,000 (2.0% rate) for identical bonds. These costs are incorporated into contractor bids as general conditions, ultimately borne by project owners through contract pricing.

Premium Payment Structures: Bond premiums can be structured various ways including upfront payment of full premium when bonds issue, installment plans spreading premiums over construction periods, earned premium calculations based on completed work percentages, or annual aggregate programs basing premiums on total bonded volume rather than individual projects.

How Performance Bond Claims Unfold

Understanding the performance bond claims process helps contractors avoid defaults and navigate challenges if problems arise:

Default Triggers: Defaults occur when contractors materially breach contracts through work stoppage or project abandonment, consistent failure to meet schedule milestones, quality deficiencies remaining uncorrected, insolvency or bankruptcy filing, failure to pay subcontractors creating work disruptions, or other material contract breaches.

Project owners must formally notify sureties of defaults, typically through written notices detailing specific failures and providing opportunities for cure periods before declaring full defaults.

Surety Investigation and Response: Upon receiving default notices, sureties conduct thorough investigations to verify default legitimacy and contract breach severity, assess project status and percentage completion, evaluate remaining work scope and cost to complete, determine original contractor’s capacity and willingness to continue, and identify most cost-effective resolution approaches.

This investigation phase is critical because sureties have substantial discretion in choosing resolution methods balancing owner protection with cost minimization.

Resolution Options: Sureties can address performance bond claims through several approaches:

- Financing Existing Contractor: If contractors have technical capability but face temporary financial challenges, sureties may provide funding, arrange credit facilities, or structure payment schedules enabling project completion. This option often proves most economical since contractors are already mobilized and familiar with work.

- Hiring Completion Contractor: When original contractors cannot or should not continue, sureties solicit bids from qualified contractors to complete remaining work. Sureties fund completion drawing on bond amounts and pursuing original contractors for reimbursement through indemnity agreements.

- Owner Completion: In some situations, sureties permit owners to complete work themselves or with contractors of their choosing, reimbursing owners for reasonable costs up to bond penalty amounts.

- Monetary Settlement: When completion is impractical or other factors make it appropriate, sureties may negotiate cash settlements with owners, paying damages equal to completion costs, schedule delays, and other legitimate losses within bond limits.

Indemnity Consequences: When contractors apply for bonds, they and typically their principals personally sign indemnity agreements requiring reimbursement to sureties for all costs incurred resolving claims, including completion costs, legal fees, investigation expenses, and administrative costs. This indemnity can extend beyond original bond penalties if resolution costs exceed bond amounts.

Contractors experiencing bond claims face severe consequences including bonding capacity termination with current sureties, difficulty obtaining bonds from other sureties due to damaged records, personal financial liability through indemnity agreements potentially affecting personal assets, industry reputation damage affecting future opportunities, and potential bankruptcy if claim costs exceed recovery capability.

Payment Bonds: Complementary Protection

Payment bonds work in tandem with performance bonds, addressing different but related risks:

Payment Bond Function: These bonds guarantee contractors will pay all subcontractors, suppliers, and laborers providing work or materials on bonded projects. Payment bonds protect downstream parties who lack direct contractual relationships with project owners.

Mechanics Lien Prevention: Without payment bonds, unpaid subcontractors and suppliers typically file mechanics liens against project properties to secure payment. On public works, government properties cannot be liened, making payment bonds essential. On private projects, payment bonds prevent lien complications and ensure equitable treatment throughout supply chains.

Claim Procedures: Payment bonds allow qualifying parties to file claims directly against bonds if general contractors fail to pay for performed work or delivered materials. The Miller Act and state equivalents establish specific procedures and timeframes for filing payment bond claims on public projects, typically requiring notice to owners, contractors, and sureties within defined periods after final work or material delivery.

Dual Bond Requirements: Most bonded construction projects require both performance and payment bonds. Federal projects under the Miller Act mandate both bond types at 100% of contract value on contracts exceeding $150,000. State Little Miller Acts impose similar dual requirements on state and local public works with varying thresholds.

Public Works Bonding Requirements: Specific Mandates

Public construction projects have unique bonding requirements contractors must understand:

Miller Act on Federal Projects: This federal legislation governs bonding on federal construction contracts exceeding $150,000. The Act requires performance bonds for 100% of contract value guaranteeing work completion, payment bonds for 100% of contract value protecting subcontractors and suppliers, bonds from sureties appearing on the Treasury Department’s approved list (T-List), and compliance with specific bond form requirements and claim procedures.

State Little Miller Acts: Every state has enacted its own Miller Act equivalent applying to state and local government construction. These laws vary significantly in threshold amounts triggering bond requirements (commonly $25,000 to $100,000), specific bond forms and certifications, claim procedures and statute of limitations, and approved surety qualifications.

Contractors pursuing public works must understand requirements in specific jurisdictions where they operate. Working with experienced agents like those at Guignard Company—an Orlando surety bid bond provider and performance bond specialist—ensures compliance with applicable requirements.

Best Practices for Maintaining Strong Performance Bond Relationships

Contractors who successfully manage performance bond requirements implement several strategic practices:

Transparent Communication: Inform your surety promptly about project challenges, financial changes, or business developments. Sureties appreciate transparency and can often provide guidance or resources before problems escalate to defaults. Hiding difficulties until they become crises damages relationships and limits resolution options.

Timely Financial Reporting: Submit financial statements according to agreed schedules—typically annually for audited or reviewed statements and quarterly for internal financials. Consistent, prompt reporting demonstrates professionalism and allows sureties to monitor financial health supporting capacity decisions.

Conservative Growth Management: Avoid overextending capacity by taking on excessive work simultaneously or pursuing projects beyond experience levels. Sustainable, controlled growth builds surety confidence and supports capacity increases over time. Aggressive expansion straining resources raises concerns and may prompt capacity restrictions.

Robust Project Controls: Implement strong project management systems including accurate job costing tracking actual vs. estimated costs, regular work-in-progress reviews monitoring all active projects, formal change order processes documenting scope modifications, proactive schedule management maintaining timeline discipline, quality control programs ensuring specification compliance, and subcontractor management systems ensuring downstream performance.

Strong controls prevent problems from developing and demonstrate professional project management capability to sureties.

Financial Discipline: Maintain adequate working capital through profitable operations generating positive cash flow, limited owner distributions preserving capital in businesses, conservative debt management avoiding excessive leverage, retained earnings accumulation building equity systematically, and equipment acquisition discipline purchasing only what operations require.

Financial strength forms the foundation of bonding capacity—contractors who manage finances strategically position themselves for capacity growth.

Working with Experienced Surety Professionals

Partnering with experienced surety bond agents offers significant advantages over approaching surety companies directly:

Market Access: As a Tampa FL construction surety bid bond provider and performance bond specialist, Guignard Company maintains relationships with over 20 surety companies ranging from large national carriers to regional specialists. This breadth allows matching contractors with sureties best suited to specific situations, project types, and contractor profiles.

Skilled Advocacy: Experienced agents present contractor qualifications in optimal light, helping sureties understand capabilities, differentiators, and project approaches. When challenges arise, agents advocate on contractors’ behalf to find workable solutions preserving bonding relationships.

Process Efficiency: Knowledgeable agents understand what information each surety requires and how to present it most effectively. This streamlines applications and accelerates approvals—critical when project schedules drive timing.

Strategic Guidance: Beyond individual bond placements, experienced agents help contractors develop long-term bonding strategies supporting growth objectives. This includes financial management advice, project selection guidance, capacity expansion planning, and surety relationship diversification strategies.

Problem Resolution: When project issues arise or surety relationships encounter difficulties, agents provide valuable intermediary services facilitating communication, developing resolution strategies, and working to maintain bonding capacity even through challenging periods.

Contact Guignard Company for Your Performance Bond Needs

Whether you’re pursuing your first bonded project or managing a sophisticated multi-million-dollar bonding program, Guignard Company provides the expertise, market relationships, and strategic guidance contractors need to access and maximize performance bond capacity.

Orlando Office

1904 Boothe Circle

Longwood, FL 32750

Phone: 407-834-0022

Serving Central Florida contractors with comprehensive performance bond solutions for commercial construction, institutional projects, and public works throughout the Orlando metropolitan area and beyond.

Tampa Office

1219 Millennium Pkwy, Ste 113

Brandon, FL 33511

Phone: 813-547-3773

Supporting Tampa Bay area contractors with expert performance bond guidance and competitive surety programs for projects throughout Florida’s Gulf Coast region.

Atlanta Office

Deerfield Corporate Center One

13010 Morris Rd, Ste 600

Alpharetta, GA 30004

Phone: 678-606-5533

Assisting Georgia contractors with sophisticated performance bond programs and strategic bonding capacity development for projects throughout the Southeast.

Performance bonds and contract bonds form essential elements of modern construction risk management, providing protections that allow complex, high-value projects to proceed with confidence for all stakeholders. Understanding how these bonds function, maintaining strong surety relationships, and implementing best practices for financial and project management position contractors for sustainable growth in competitive markets.

Guignard Company’s extensive experience helping contractors access and manage performance bond programs, combined with our comprehensive surety market relationships and commitment to responsive service, ensures you receive the support necessary to pursue ambitious projects confidently. Our team of seasoned professionals understands the unique challenges contractors face and provides tailored guidance addressing specific situations and objectives.

Contact us today to discuss your performance bond requirements and discover how our expertise can help you access larger projects, expand your market reach, and build a bonding program supporting your long-term business vision. We stand ready to provide the market access, strategic counsel, and ongoing partnership that separate thriving bonded contractors from those who struggle with surety relationships and capacity constraints.